alameda county property tax payment

One moment please while we direct you to the Property Tax Information web site. The following information and services can be accessed with any touch-tone telephone 24-hours a.

Alameda County Ca Property Tax Calculator Smartasset

You may pay by check money order cashiers check or certified check.

. Levy the Alameda County Treasurer-Tax Collector regarding the benefits of paying your Property Tax using the Alameda County E-Check System. FAQs Tax Defaulted Land Information about our public auctions including results. This service is designed to offer you the following.

More Information Business License Tax. Unfortunately our computer systems cannot accept payments for more than the two installments each year. Use a service like Easy Smart Pay.

Who do I make my check payable to. View Alameda County Property Tax Bills. The tax payment should be mailed to.

Winton Ave Room 169 Hayward. Bill of Alameda County Property Tax. Pay by E-CHECKCREDIT CARDS is free of charge.

The due date for property tax payments is found on the coupon s attached to the bottom of the bill. 11 hours agoIn Alameda and Contra Costa counties a family of four would have to make 214200 or less per year to qualify. The convenience of paying your taxes from your home work or anywhere that you have access to the internet.

Alameda County Property Taxes Payment With E-check. 2 How to make the Alameda County Property Tax Payment Online. Last day to pay second installment of property taxes without penalty.

Alameda County Administration Bldg. Pay Now Frequently Asked Questions Answers to the most frequently asked questions about property taxes. How to Pay Property Tax using the Alameda County E-Check System Other Methods To Pay Pay property tax by phone mail in person and wire transfer.

Pay Your Property Taxes - Alameda Countys Official Website. Images posts videos related to Alameda County Property Tax Payment Discussion Gov Newsoms 0812 COVID-19 Press Conference. Design by Kristin Brown Alameda County Treasurer-Tax Collector Henry C.

If you are not automatically directed to a new page click this link. What information is provided on the 24-Hour Property Tax Payment and Information System. Information on due dates is also available 247 by calling 510-272-6800.

Select the option to start invoice payments. The cutoff is 279600 in San Mateo county and San Francisco and 252750 in Santa. Below is my live transcript of Governor.

The TTC accepts payments online by mail or over the telephone. Unfortunately our computer systems cannot accept payments for more than the two installments each year. We are also pleased to provide the convenience of Online Payments.

After fill in the contact and credit card user information. However there may be other solutions for you to consider. Call your lender and Get Set up on an Impound Account.

Also you can place your check payment in the drop box located at the lobby of the County Administration Building at 1221 Oak St. A message from Henry C. Use a service like Easy Smart Pay.

Alameda County Property Taxes Payment With Credit Card. How do I get another bill. These collections are deposited to Union Bank for investments and payment of disbursements made by the offices in the County.

The Difference Between E-Check Payment vs Online Banking Payment. The Alameda County Treasurer-Tax Collector Continues to Encourage Online Payment for 2020-2021 Property Taxes. The Cashiers Section takes the deposit from the offices within the County and payments of taxes from taxpayers.

Set up an account with your bank. The ability to pay your Taxes at your convenience 24x7. Oakland or through the mail slot at the Business License Tax Office at 224 W.

Levy the Alameda County Treasurer-Tax Collector regarding the benefits of paying your Property Tax using the Alameda County E-Check System. Alameda County Property Taxes Payment With Credit Card If we are going to pay with the credit card option we will select the value fill in the terms acceptance box and click on the Continue To Pay Contact button. Set up an account with your bank.

The bulk of the payments are received in August for Unsecured Taxes and December and April for Secured Taxes. 1221 Oak Street Room 536 Oakland Ca. However there may be other solutions for you to consider.

Property Tax Cash Payments Accepted by East West Bank. This discussion series is meant to spur discussion and problem solving within the community in regards to the novel COVID-19 outbreak. Call your lender and Get Set up on an Impound Account.

This video is private The difference between Alameda Countys E-Check Payment versus Online Banking Payments. Legal deadline for filing a late exemption claim for homeowners veterans and disabled veterans. How to Pay Online A message from Henry C.

The Alameda County Treasurer-Tax Collector Announces Policies and Procedures for COVID-19 Related Delinquent Property Tax Penalty Interest Waiver. Levy released publicly Monday the policies and procedures by which his office will be processing requests to waive penalties and interest related to delinquent property tax payments caused by the COVID-19 crisis. Alameda County Treasurer-Tax Collector 1221 Oak Street Room 131 Oakland CA 94612.

Alameda County Treasurer-Tax Collector Pay Your Property Tax Pay your secured supplemental or unsecured property tax. Alameda County Property Tax Payment.

Transfer Tax Alameda County California Who Pays What

Decline In Market Value Alameda County Assessor

Senior Citizens Disabled Person S Alameda County Assessor

How To Pay Property Tax Using The Alameda County E Check System Alcotube

California Public Records Public Records California Public

Alameda Unified Ausdnews Twitter

Alameda County Property Tax News Announcements 11 08 21

Search Unsecured Property Taxes

Piedmont Civic Association Piedmont California Sewer Surcharge And Other Piedmont Parcel Taxes Not Tax Deductible

Alameda County Taxpayers Association Inc Home Facebook

Transfer Tax Alameda County California Who Pays What

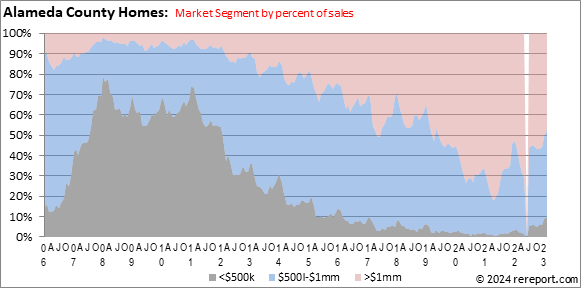

The Alameda County Real Estate Report

How To Pay Property Tax Using The Alameda County E Check System Youtube